At the end of May 2020, analysts were talking disaster. The market for manufacturing technology was going into a tailspin. Companies were addressing canceled orders and sales calls, looking at employee furloughs, and striving to keep credit lines open. In the following months, the market became hostile, and the customer was setting the mark in negotiations. Fortunately, that chaos was short-lived. Cutting tool orders seemed to hit bottom in July with respect to the three-month moving average, and two months later, the same metric for manufacturing technology hit bottom. Since then, the cutting tool moving average has continued steadily upward, and manufacturing technology’s three-month moving average moved upward in its typical saw-tooth fashion. Still, it is clear that a recovery is in process and is likely to pick up speed as the number of people getting vaccinated grows.

Mark Killion of Oxford Economics said as much during his MTForecast presentation in October and reiterated that position during his recent forecast update on IMTS spark on Jan. 29. Mark noted that in just the short three months since he presented that forecast, Oxford’s manufacturing technology outlook had improved 5% for 2020. As a result, the overall forecast for 2020 and 2021 suggests that 2021 will finish about 5% short of 2019 orders. The positive takeaway is that this is significantly better than the 11% shortfall that analysts predicted for 2021 in May 2020.

The USMTO December report was terrific. December orders were 39% greater than November levels, and it was the only $400 million-plus month in 2020. December’s $457 million was also 18% larger than December 2019, yielding a 2020 total 15% shy of the 2019 year-end figure. The fourth quarter of 2020 was a tremendous comeback for our industry and set the stage for a great 2021. AMT predicts manufacturing technology orders to outperform analysts’ expectations this year with orders up by more than 20%. At the end of last year, the auto, construction equipment, transportation, fabricated metal products, and job shop industries finished strong with December totals better than December 2019. Still, it is important to remember that U.S. manufacturing technology producers export between a quarter and two-fifths of what they make in the United States. That is comparable to what the auto and job shop industries represent in the domestic order base.

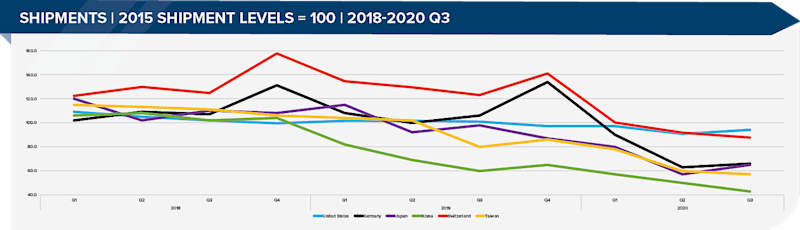

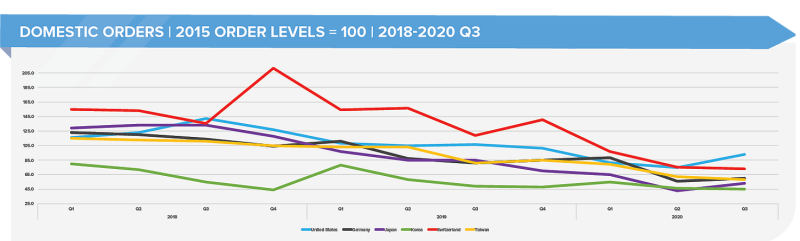

Healthy growth will require expansions in North America, Europe, and Asia in addition to the United States. AMT collaborates with other manufacturing technology trade associations around the world. A quarterly exchange of key market and industry metrics of our domestic manufacturing technology is one of those collaborations. Included with this article are two graphs depicting domestic orders and domestic producers’ shipment indices. The domestic orders index is a good read on the health of customer industries in that market through the rate of change in their manufacturing technology capital investment. The shipment index is a good gauge on the health of the manufacturing technology in that country.

Looking at 2020 domestic orders indices in international markets, the Austrian market bounced back from the pandemic the fastest as they are at 98% of their 2015 levels. Keep in mind, 2015 was not as good a year for some nations as it was for others, but analysis of the index over time is a valid measure for growth in markets and industries. The United States had the second-best rebound in 2020, with the orders index in the third quarter at 93 with a low of 75 in the second quarter. Austria, France, Japan, Germany, and the United States seemed to bottom out in the second quarter and began their rebound in the third quarter. Industrial customers in these countries are on the mend.

The health of manufacturing technology industries was broader than the domestic markets in reporting countries. Seven of 12 countries saw manufacturing technology shipments (domestic and exports) expand in the third quarter of 2020 while only five of 12 saw their domestic orders expand in the same period. The United States saw manufacturing technology shipments from U.S. factories grow to 94% of their 2015 levels from a low of 91%. Austria, the Czech Republic, France, Germany, Japan, and the U.K. all saw a pickup in shipments between the second and third quarters. This is good news for France, as they had seen shipments fall to 24% of 2015 levels before the rebound in the third quarter to 57%.