In recent years, emerging technologies appeared to be on a never-ending news treadmill missing a “stop” button. But late in the first quarter of 2020, like everywhere else, that button appeared and was pushed, bringing the manufacturing technology sector to a halt. The subsequent recovery in the following 21 months led to the most active investment period on record for robotics, additive manufacturing, and the surrounding industrial software ecosystem.

Evaluating the past, present, and future of an emerging manufacturing technology category benefits most from analyzing leading indicators whenever possible. In high-growth technologies or industries, financial investments and acquisitions are announced publicly within days or weeks and often include dollar amounts. The investment announcements, when taken in aggregate, reflect the collective entrepreneurial effort of a sector and the interest level from financial investors as well as select corporate strategic investors. Similarly, acquisitions represent corporate interests in a technology’s future and, to a lesser extent, a maturation of the industry. Reviewing these data and trends was supposed to tell us if we were finally there, but they instead highlighted a different question: Where are we going?

Robotics and Automation

As a technology category, robotics and automation companies can be categorized broadly by the task types they intend to accomplish. For example, functional robotics companies develop application-specific solutions for agriculture, food preparation, or construction. Industrial robotics are more general and often serve as a platform solution, such as product assembly, in numerous industries. By contrast, health care and service robots serve the medical and hospitality sectors, respectively. More human-focused companies fall under education, to support STEM initiatives, or adaptive, to serve collaborative or social purposes. The last category, technology, represents the companies developing hardware, software, data, and services that enable all the tasks one can imagine.

Global venture capital (VC) investment in robotics and automation companies has grown 67.4% annually from $532 million in 2016 to $7 billion in 2021. Any lost momentum from 2020 was regained with more than double the $2.9 billion in capital committed in 2021. Within this feverish excitement to capture market share, the largest increases in investment over the last five years were in health care, industrial, and service robots.

Despite the attractive high margins in industrial, service, or health care applications, the $3.29 billion in combined funding for 2021 was slightly more than functional and technology companies in that year and, to an even greater extent, over the last five years. When a technology category takes off like this, acquisitions often track accordingly because large corporations are looking to buy time and acquire innovative smaller groups rather than miss opportunities attempting to build the same products or services internally. As a result, each of the last five years saw 17 mergers or acquisitions on average, with 2021 recording a high of 29 in line with investment activity.

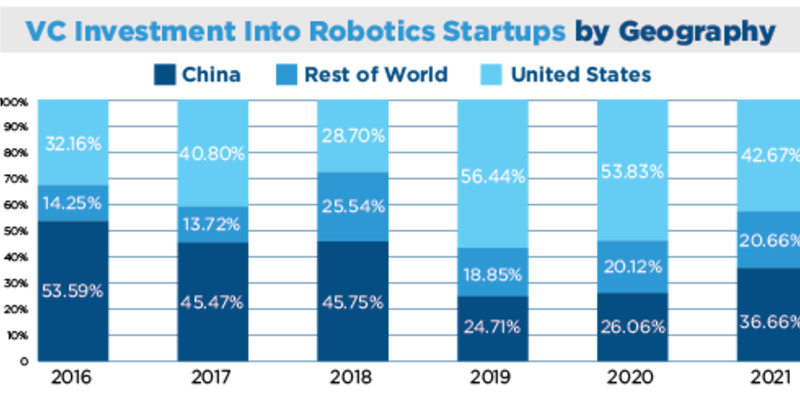

Geographic trends in robotics VC activity have unsurprisingly highlighted two powerhouse countries: China and the United States. In the last five years, VC groups have invested more than $14.2 billion, or 79.3% of all robotics investment dollars, into companies headquartered in these two countries. U.S. robotics companies received more capital than Chinese robotics companies in every year since 2019. When comparing the investment profile, there were 144 U.S. and 129 Chinese companies in each country attracting this funding since 2016 and across a similar category distribution except in 2019 and 2021.

Additive Manufacturing

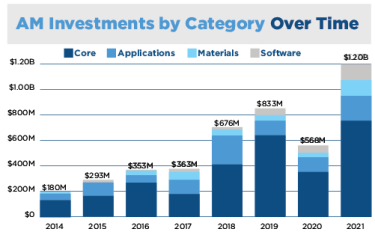

Investments in additive manufacturing (AM) are grouped into four categories. Core investments represent AM processes, 3D printers, and post-processing equipment developers alongside printing service providers, online marketplaces, and other hardware technology enablers. The software category represents companies with a specialization in additive manufacturing software across any part of the computer-aided design, engineering, or manufacturing workflow. Applications companies include specialized service companies focused on a particular industry or product class, such as heat exchangers, aerospace and defense, or medical implants. Lastly, materials investments cover materials suppliers, formulators, and developers.

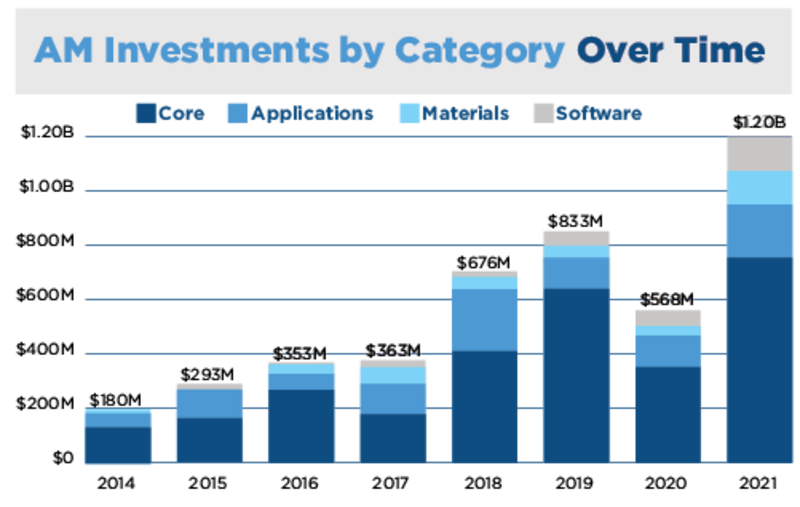

Global venture capital investment in additive manufacturing companies has grown 28% annually from $353 million in 2016 to $1.2 billion in 2021. Any lost momentum from 2020 (down $265 million) was regained twice over in 2021 (up $631 million). The pandemic-related delay in funding from 2020 added on to expected investment needs in 2021 and resulted in more than double the demand for VC funding.

More impressive than the demand was how it was satisfied: Average deal size increased to a record high of $19 million. Larger investment rounds most likely represent a combination of increased valuations and the overall startup landscape growing up. Of the four categories – core, applications, materials, and software – the market share by software topped the growth rate, starting from a mere $3 million in 2016 to $125 million in 2021, while the other three have largely centered around the 28% CAGR.

Despite software’s explosive growth, it was the smallest category in 2016 at $3.3 million and is now on par with applications and materials categories in 2021 at $128 million. Despite the materials, software, and applications categories collectively now making up 36% of investments ($437 million) in 2021, these areas are still underfunded relative to the core companies and are hindering the broader adoption of AM.

Mergers and acquisitions (M&A) in additive manufacturing have grown in number from 2017 with 17 events to 29 in 2019, before dropping down to 2020’s respectable 25, despite disruptions. In the same way that investments were delayed due to widespread uncertainty, M&A events saw a record year in 2021 with 49 companies finding new ownership. The drivers here were not simply a result of delayed action in 2020; the pandemic pushed 3D printing back into the public spotlight and secondarily highlighted the larger, privately held 3D-printing companies as targets for listing publicly via special purpose acquisition companies (SPACs).

Irrespective of the approach to go public, the result was an avalanche of new money available to traditional, big-name, 3D-printing groups like 3D Systems as well as newly public 3D-printing companies such as Desktop Metal, Markforged, Velo3D, and services companies Fathom and Shapeways. In comparison to the much larger robotics industry, additive manufacturing saw nearly double the M&A activity in 2021. This pace may bring some to claim AM has arrived, but only 2022 and 2023 will reveal how this excess capital and M&A activity trickles down and converts into technology adoption and sustainable growth.

Industrial Software

Industrial software is an amalgamation of business models, technologies, and applications that ideally connect manufacturing technologies together with the necessary management, control, and implementation resources. Whether it’s a part design workflow or a sensor-based predictive maintenance schedule, software is now instrumental in every aspect of delivering products or providing services. The uncertainty that comes with common phrases such as digital transformation, digital twin, Industry 4.0, and digitalization can be better represented by emerging technology companies that have a real value proposition and brand-name customers.

Robotics, automation, and additive manufacturing come together around a few select trends.

At the part and product level, design workflows (CAD/CAE/CAM) are increasingly being offered as an integrated experience on the cloud. Looking one level up, manufacturing execution systems, product lifecycle management, and enterprise resource planning are now integrating in cloud environments with design workflows aiming for systemwide efficiency. Tying into this idealized multilevel system is the risk mitigation aided by collecting sensor data at the equipment and personnel level to predict maintenance concerns before they escalate.

To compliment the system-level goals of industrial software within a company, some offerings, such as network manufacturing platforms (or “marketplaces”), are addressing market-level inefficiencies. Without the dozens of core companies in industrial software enabling efficiencies, the physical manufacturing world remains at a standstill. Despite the intermingling of industrial software with AM and robotics, more than $1.6 billion in venture capital has been invested since 2016 to enable the physical manufacturing ecosystem.

Are we there yet? At least $8.2 billion in emerging technology investments in 2021 argue that we have arrived. Looking forward, however, this amount is now the new baseline for growth and will only accelerate manufacturing technology changes in the next five years.