In the last days of October, AMT’s annual MTForecast event was delivered virtually for the first time in its 48-year history. The format may have been different, but the value was as great as ever, even if the news was bittersweet. The speakers painted a multifaceted recovery, with some industries, like the medical equipment industry, growing faster in 2020 than 2021. Others, like the aerospace industry, are not likely to return to 2019 production levels before 2022. The broad takeaways were that the rebound in manufacturing is likely to slow its pace in the fourth quarter of 2020 but continue to grow, sans another major lockdown. A significant portion of the manufacturing technology market (25%-30%) could take two or more years to rebound. Finally, new technologies and automation are outperforming traditional technologies during these trying times.

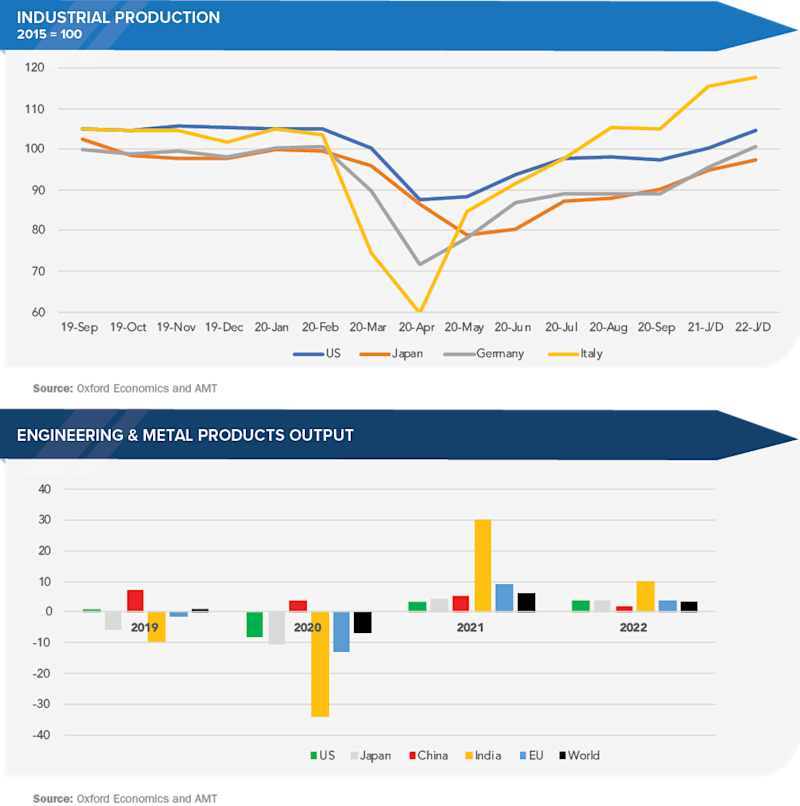

The picture of economic recovery overseas was just as mixed as the picture of industrial markets’ prospects in the United States. Oxford Economics released a report recently that focused on the “engineering and metal goods” (EMG) sector of manufacturing, which is somewhat comparable to what we refer to in the United States as industrial machinery, fabricated products, and electrical machinery. China’s rebound from the pandemic-induced recession occurred in 2020, and output by the industries that are the top consumers of manufacturing technology is miraculous. On the other hand, India’s output of these products is expected to fall by 34% in 2020. On a global basis, EMG output is forecast to fall by 7% in 2020 and rebound 6% in 2021. The sector will regain its 2019 levels in early 2022. This scenario aligns with expectations of industrial production levels projected for the major global economies.

India’s progress will slow in the fourth quarter as the government’s relatively small fiscal stimulus (1.3% of GDP) and the impact on capital expenditures will be dire. Although the output in EMGs will fall by 34% in 2020, overall industrial production is expected to fall only 10%. Both export and import trade are down, but imports have fallen by twice the rate of exports. As a result, India is realizing a net improvement in the trade balance and lowering of its global debt. These positives will fuel growth in manufacturing as the general economy improves with the lockdowns easing across the country. Expectations are for India to be one of the fastest-growing economies in the world over the next five years and that the EMG sector output will expand by 30% in 2021 and double-digit rates in the extended timeframe.

Germany and the eurozone producers of manufacturing technology have been severely impacted by COVID and the lockdowns’ impact on international trade. Perhaps only Japan exports a more significant percentage of its manufacturing technology and EMG products. The export slowdown has Germany and the European Union producers of manufacturing technology in a bind. Italy is a bit of an exception as a good portion of their exports of capital equipment remain on the continent, which is why their industrial production levels and forecasts look better than the rest of the EU, including Germany. The expectations are that the EMG sector will expand faster than manufacturing as a whole, with exports picking up again and the strong rebound in motor vehicles currently underway. Germany and the EU are looking at declines in output in the EMG sector of 10% and 15% respectively, and both are projected to expand by 10% in 2021.

Japan’s EMG sector output is on pace to be down 11% in 2020 with a modest improvement in 2021. The heaviest-hit products in the sector will be the output in machine tools, which is forecast to be down 23% from 2019 production levels. Japan’s reliance on exports of EMG products is very significant and raises the likelihood of a strong recovery in demand for EMG products from overseas markets. Analysts predict the U.S.-China trade conflict may help Japan expand exports of its products to both countries. Japan’s government has been aggressive in providing fiscal support to both consumers and manufacturers, which has helped mitigate the drop in output and keep the manufacturing sector producing at good capacity utilization rates. Expectations are for very modest growth fueled by continued demand and that rates of growth will accelerate as inventories decline.

I encourage you to investigate subscribing to the MTForecast content if you are interested in an in-depth look at the U.S. market for manufacturing technology. The general sessions and breakouts were all taped this year, and both the recordings and presentations are available. I would point to the breakout sessions on opportunities that include presentations on renewable energy and the aerospace industry’s defense/space segment. It’s a great value and provides access to the Oxford global forecast by country and industry for manufacturing technology. You can find the information at