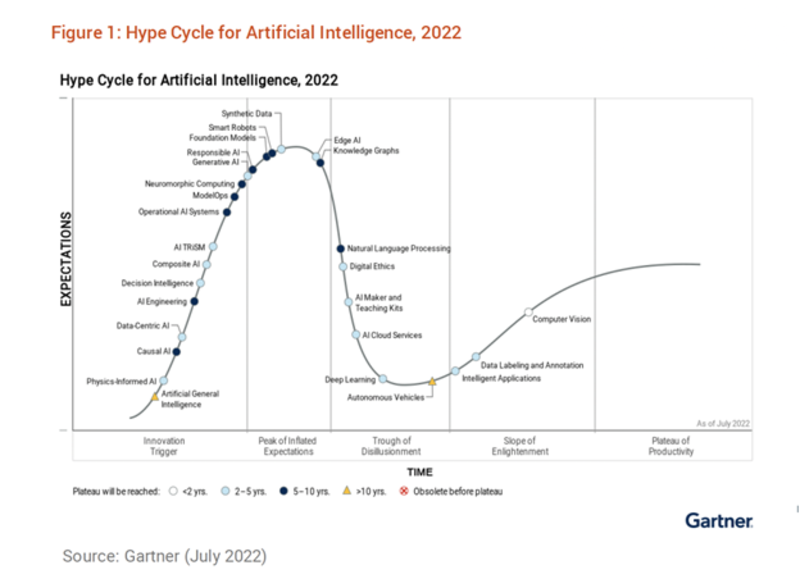

We’ve all seen or heard of the “.” It’s a visual depiction of the lifecycle stages a technology goes through from the initial development to commercial maturity. It’s a useful way to track what technologies are compatible with your organization’s needs. There are five stages of the hype cycle, which take us through the initial excitement trigger, that leads to the peak of inflated expectations followed by disillusionment. It’s only as a product moves into more tangible market use, sometimes called “the slope of enlightenment”, that we start to reach full commercial viability.

Working with so many robotics startups, I see this stage as the transition into revenue generation in more than pilot use cases. This is the point where a startup no longer needs to nurture each customer deployment but can produce reference use cases and start to reliably scale. I think this is a useful model but that the classifications by Gartner don’t do robotics justice. For example, this recent chart puts smart robots at the top of the hype cycle.

Robotics is a very fast moving field at the moment. The majority of new robotics companies are less than five to 10 years old. From the perspective of the end user, it can be very difficult to know when a company is moving out of the hype cycle and into commercial maturity because there aren’t many deployments or much marketing at first, particularly compared to the media coverage of companies at the peak of the hype cycle.

So, here’s where I think robotics technologies really fit on the Gartner Hype Cycle:

Innovation trigger

Voice interfaces for practical applications of robots

Foundational models applied to robotics

Peak of inflated expectations

Large Language models - although likely to progress very quickly

Humanoids

Trough of disillusionment

Quadrupeds

Cobots

Full self driving

Powered clothing/Exoskeletons

Slope of enlightenment

Teleoperation

Cloud fleet management

Drones for critical delivery to remote locations

Drones for civilian surveillance

Waste recycling

Warehouse robotics (pick and place)

Hospital logistics

Education robots

Food preparation

Rehabilitation

Plateau of productivity

Robot vacuum cleaners (domestic and commercial)

Surgical Robots

Warehouse robotics (AMR in particular)

Factory automation (robot arms)

3D printing

ROS

Simulation

AI, in the form of Large Language Models (i.e., , GPT3 and ) is at peak hype, as are humanoid robots, and perhaps the peak of that hype is the idea of RoboGPT, or using LLMs to interpret human commands to robots. Just in the last year, four or five new humanoid robot companies have come out of stealth from , , , , , , and so far only Halodi has a commercial deployment doing internal security augmentation for .

Cobots are still in the trough of disillusionment, in spite of selling 50,000+ arms. People buy robot arms from companies like Universal primarily for affordability andease of setup. They do not require safety guarding hardware and are capable of industrial precision. The full promise of collaborative robots has had trouble landing with end users. We don’t really deploy collaborative robots engaged in frequent hand-offs to humans. Perhaps we need more dual armed cobots with better human-robot interaction before we really explore the possibilities.

Interestingly the trough of disillusionment generates a lot of media coverage but it’s usually negative. Self-driving cars and trucks are definitely at the bottom of the trough. Whereas powered clothing, exoskeletons, or quadrupeds are a little harder to place.

AMRs, or autonomous mobile robots, are a form of self-driving cargo that is much more successful than self-driving cars or trucks traveling on public roads. AMRs are primarily deployed in warehouses, hospitals, factories, farms, retail facilities, airports, and even on the sidewalk. Behind every successful robot deployment there is probably a cloud fleet management provider, a teleoperation provider, or a monitoring service.

Finally, the plateau of productivity is where the world’s most popular robots are. Peak popularity is the Roomba and other home robot vacuum cleaners. Before their acquisition by Amazon, iRobot had sold more than 40 million Roombas and captured 20% of the domestic vacuum cleaner market. Now commercial cleaning fleets are switching to autonomy as well.

And, of course, productivity (not hype) is also where the workhorse industrial robot arms live with ever increasing deployments worldwide. The (IFR) reports that more than half a million new industrial robot arms were deployed in 2021, up 31% from 2020. This figure has been rising pretty steadily since I first started tracking robotics back in 2010.

What does your robotics hype cycle look like? What technology would you like me to add to this chart? Contact Andra at AKeay@amtonline.org.