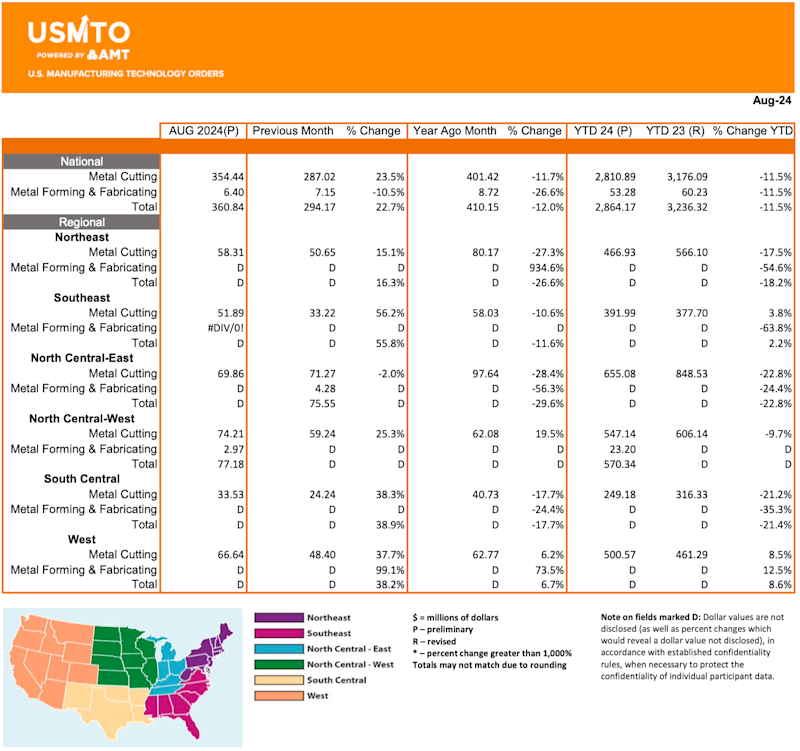

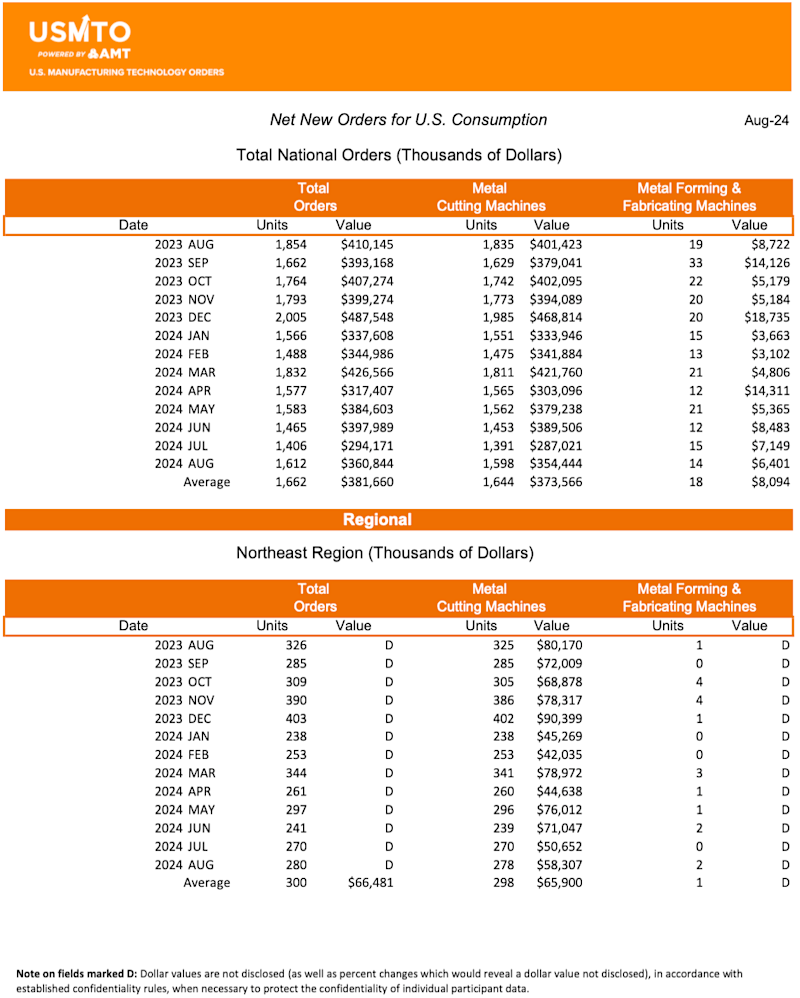

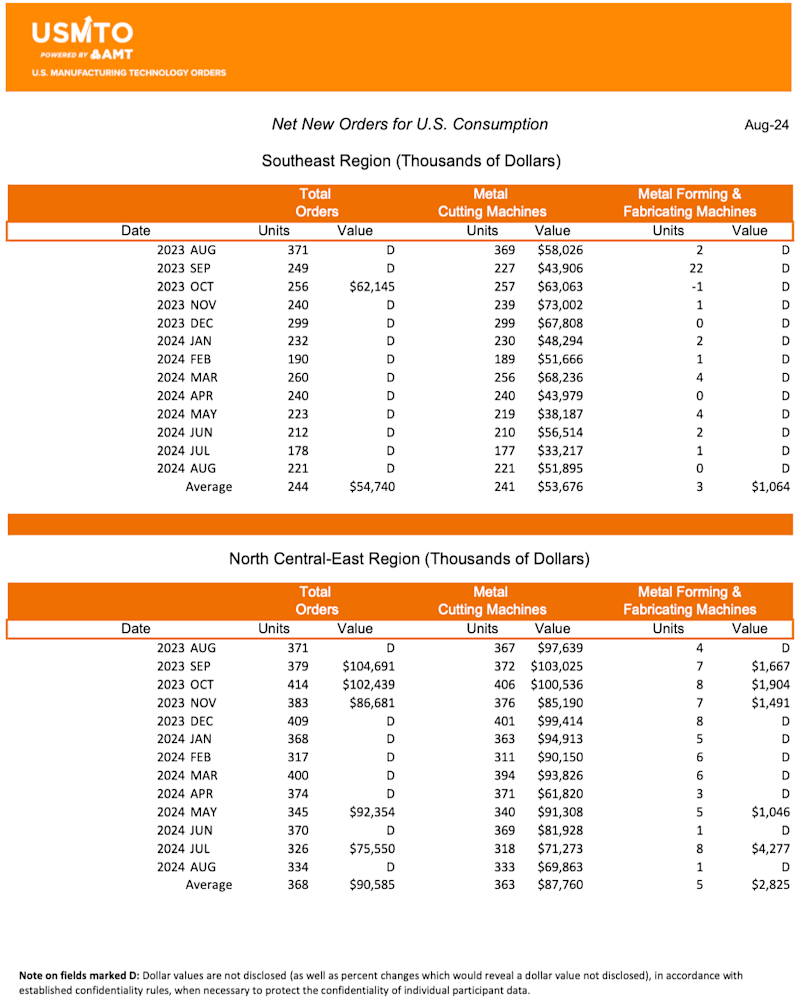

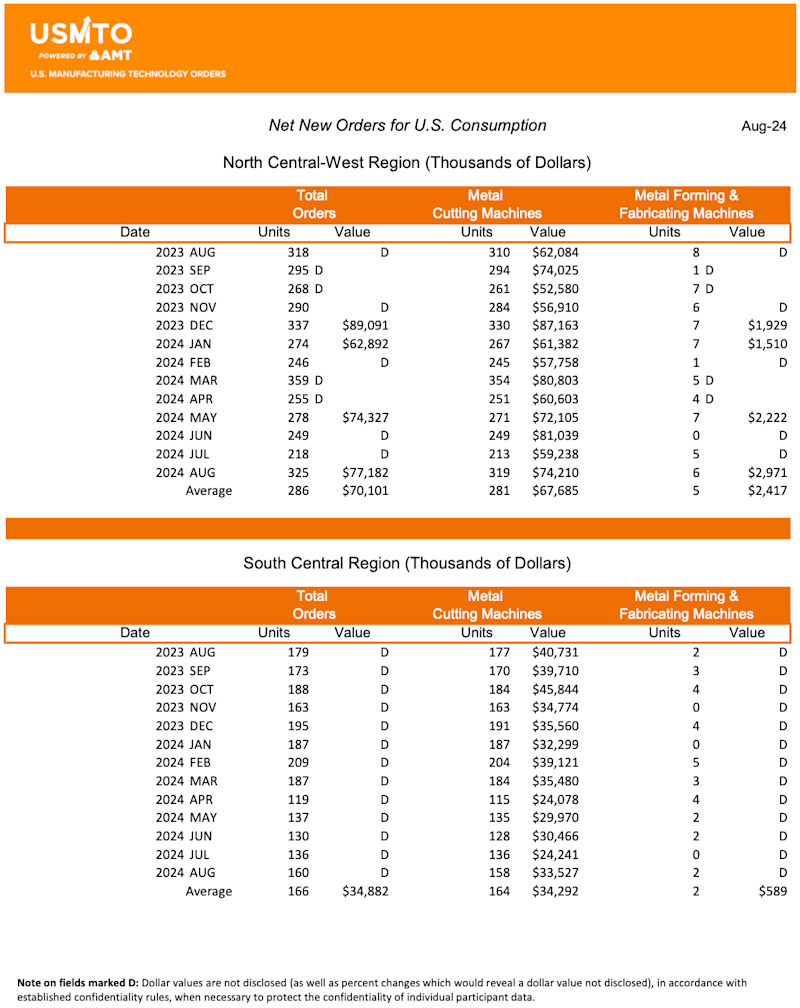

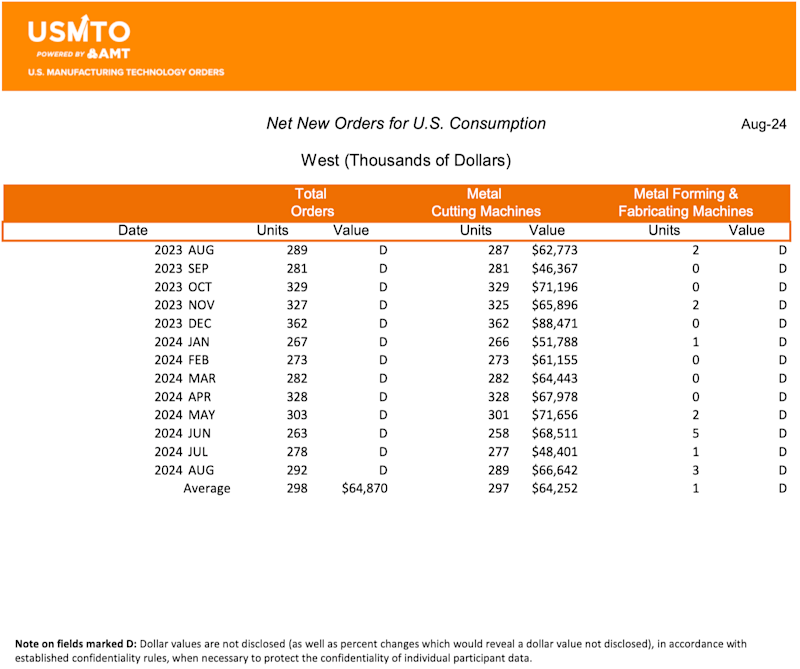

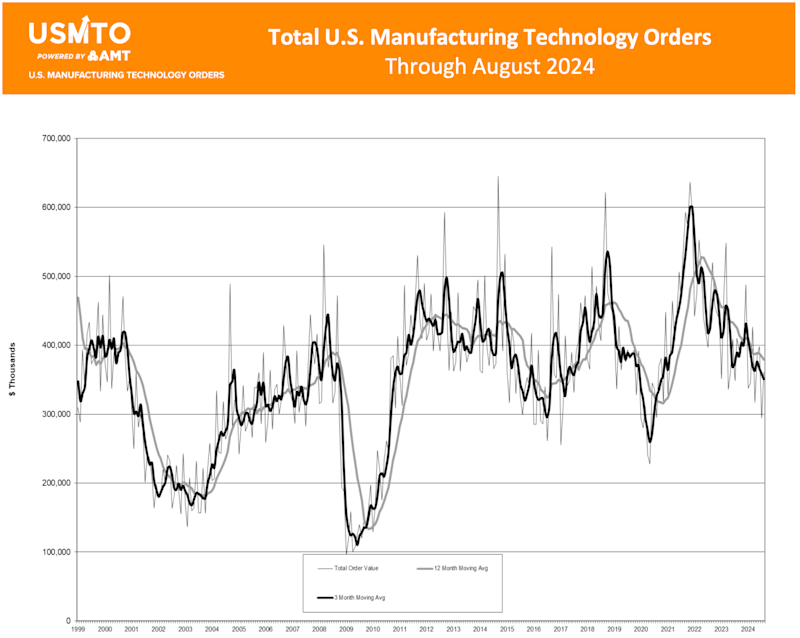

McLean, Va. (October 14, 2024) т Orders of manufacturing technology, measured by the U.S. Manufacturing ЖМСщЬхг§жБВЅ Orders (USMTO) report published by AMT т The Association For Manufacturing ЖМСщЬхг§жБВЅ, totaled $360.8 million in August 2024. These orders for metalworking machinery increased 22.7% from July 2024 but fell 12% short of August 2023 orders. Year-to-date orders reached $2.81 billion, a decline of 11.5% compared to the first eight months of 2023.

While orders continue to lag behind those placed in 2023, the level of order activity remains above historic levels. August 2024 orders are 3.8% above those placed in a typical August. This trend indicates the industry is still undergoing a period of normalization following the COVID disruptions rather than a true decline. across durable goods manufacturers indicate a very real need for additional investment in manufacturing technology.

Contract machine shops, the largest customers of manufacturing technology, increased both the number of units ordered and the value of their orders for the first time since March 2024. This growth in a key customer segment is a welcome sign after a sluggish July saw the lowest value of orders since May 2020 and the fewest units ordered since July 2010. Since job shops typically absorb elevated capacity needs from OEMs, this buying trend indicates that production could continue to grow.

Manufacturers in the aerospace sector increased the value of their orders by 13% from July to August 2024, but the number of units increased by nearly 27% in that same time. This indicates their purchases are for additional capacity, which is confirmed by the in the sector. While machinery orders from manufacturers of aerospace parts have been strong in the past few months, the has the potential to dampen this demand. It would be tempting to compare this to the 2023 United Autoworkers strike, which had almost no impact on orders for manufacturing technology from the automotive sector. However, at that time, the automotive industry had already been pulling back orders after a over the summer of 2023. Additionally, and leading into the strike. The aerospace sector is in a decidedly different position, with increased orders, a buying cycle on an upswing, and capacity utilization increasing for the past three years. Only time will tell how the Boeing strike could impact machinery orders.

Although August 2024 orders fell short of those placed in 2023, the outlook for the remainder of the year remains optimistic. The , the largest manufacturing technology trade show in the Western Hemisphere, was a welcome sign that manufacturers are in need of additional capacity as well as solutions to improve quality and efficiency. With the upcoming U.S. presidential election and the and signaling additional reductions, two of the major issues giving pause to additional capital investment will be alleviated by yearтs end. Given these factors, as well as the coming expiration of bonus depreciation of capital equipment, the momentum of order activity in the last four months of 2024 will likely accelerate and could carry over into 2025, as forecast by experts at AMTтs annual .

# # #

The United States Manufacturing ЖМСщЬхг§жБВЅ Orders (USMTO) Report is based on the totals of actual data reported by companies participating in the USMTO program. This report, compiled by AMT т The Association For Manufacturing ЖМСщЬхг§жБВЅ, provides regional and national U.S. orders data of domestic and imported machine tools and related equipment. Analysis of manufacturing technology orders provides a reliable leading economic indicator as manufacturing industries invest in capital metalworking equipment to increase capacity and improve productivity. .

AMT т The Association For Manufacturing ЖМСщЬхг§жБВЅ represents U.S.-based providers of manufacturing technology т the advanced machinery, devices, and digital equipment that U.S. manufacturing relies on to be productive, innovative, and competitive. Located in McLean, Virginia, near the nationтs capital, AMT acts as the industryтs voice to speed the pace of innovation, increase global competitiveness, and develop manufacturingтs advanced workforce of tomorrow. With extensive expertise in industry data and intelligence, as well as a full complement of international business operations, AMT offers its members an unparalleled level of support. AMT also produces IMTS т The International Manufacturing ЖМСщЬхг§жБВЅ Show, the premier manufacturing technology event in North America. AMTonline.org.

IMTS т The International Manufacturing ЖМСщЬхг§жБВЅ Show is where the creators, builders, sellers, and drivers of manufacturing technology come to connect and be inspired. Attendees discover advanced manufacturing solutions that include innovations in CNC machining, automation, robotics, additive, software, inspection, and transformative digital technologies that drive our future forward. Powered by AMT т The Association For Manufacturing ЖМСщЬхг§жБВЅ, IMTS is the largest manufacturing technology show and marketplace in the Western Hemisphere. With more than 1.2 million square feet of exhibit space, the show attracts visitors from more than 110 countries. IMTS 2022 had 86,307 registrants, featured 1,816 exhibiting companies, saw over 7,600 people attend educational events, and included a Student Summit that introduced the next generation to manufacturing. Be the change at IMTS 2024, Sept. 9-14, 2024. Inspiring the Extraordinary. .