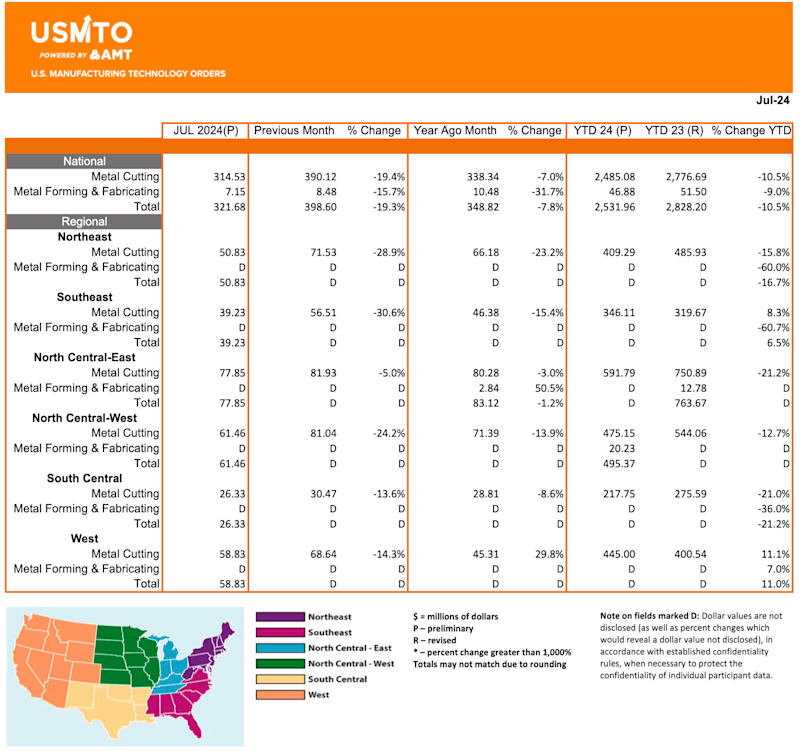

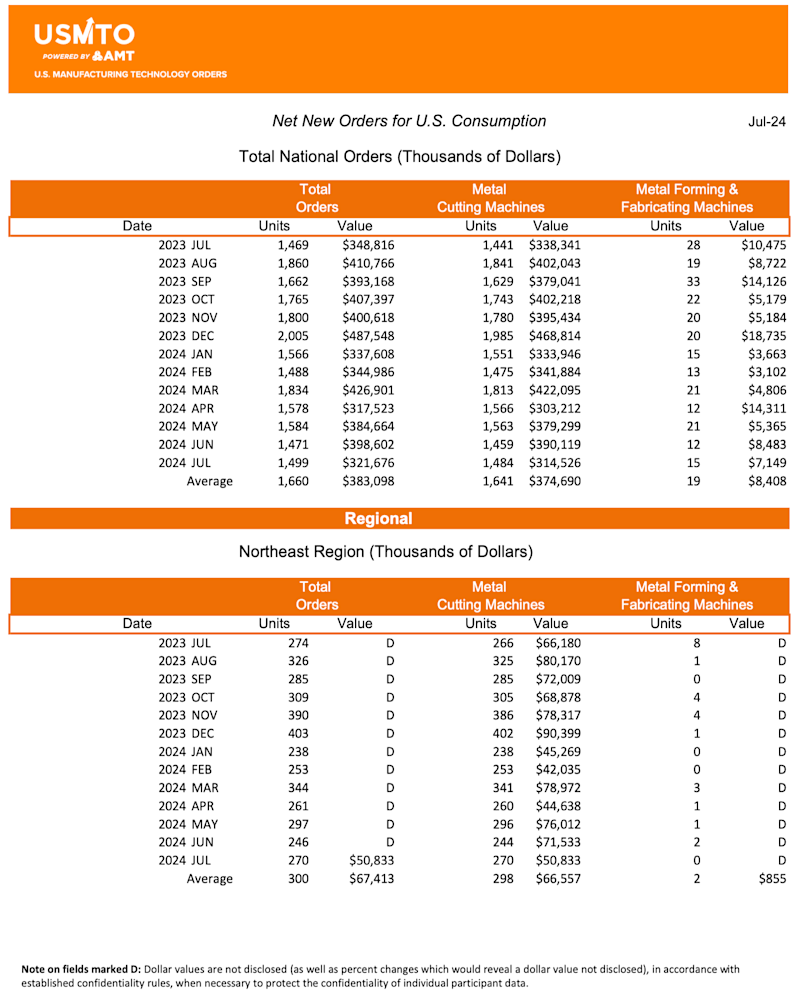

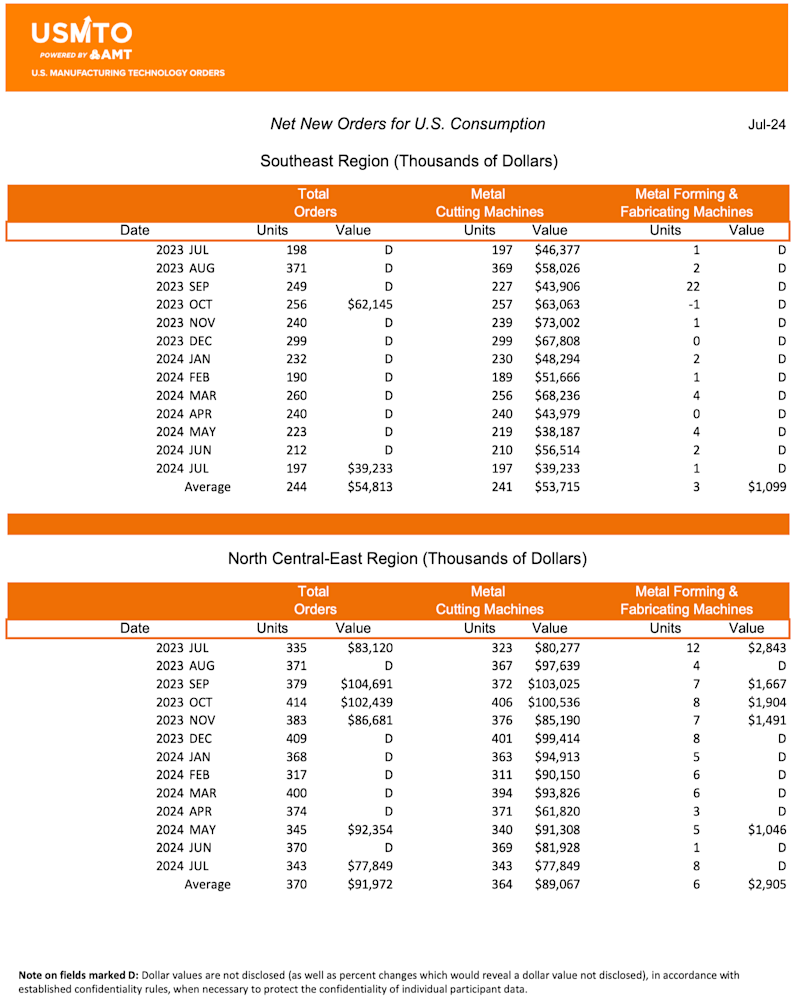

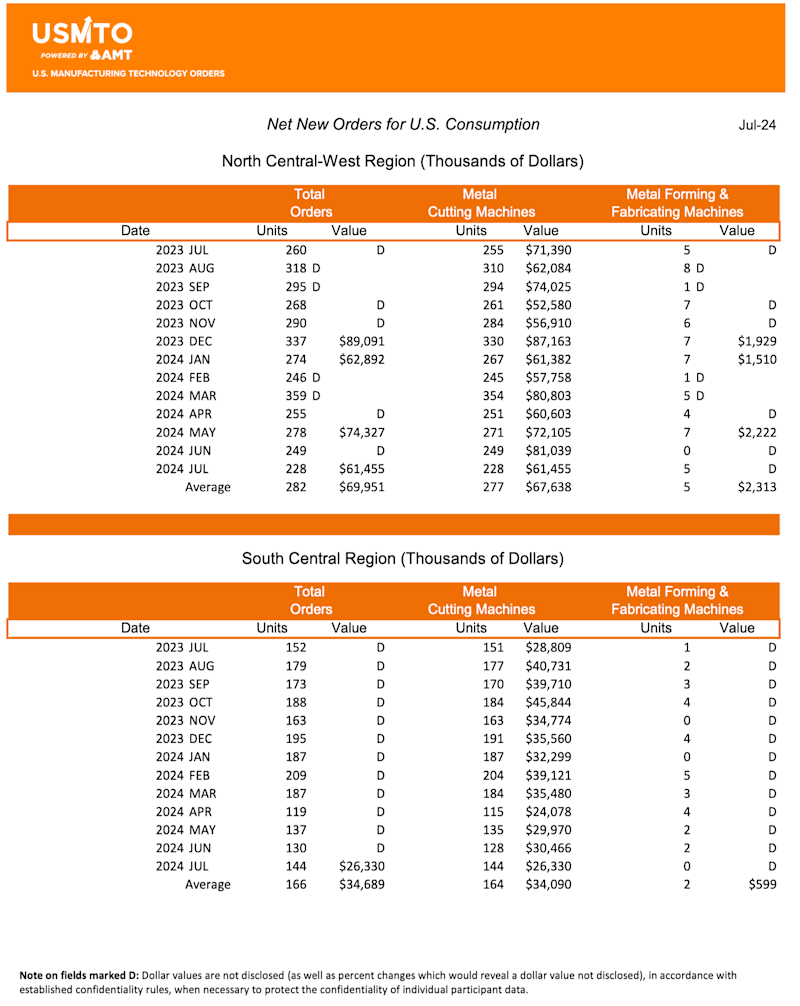

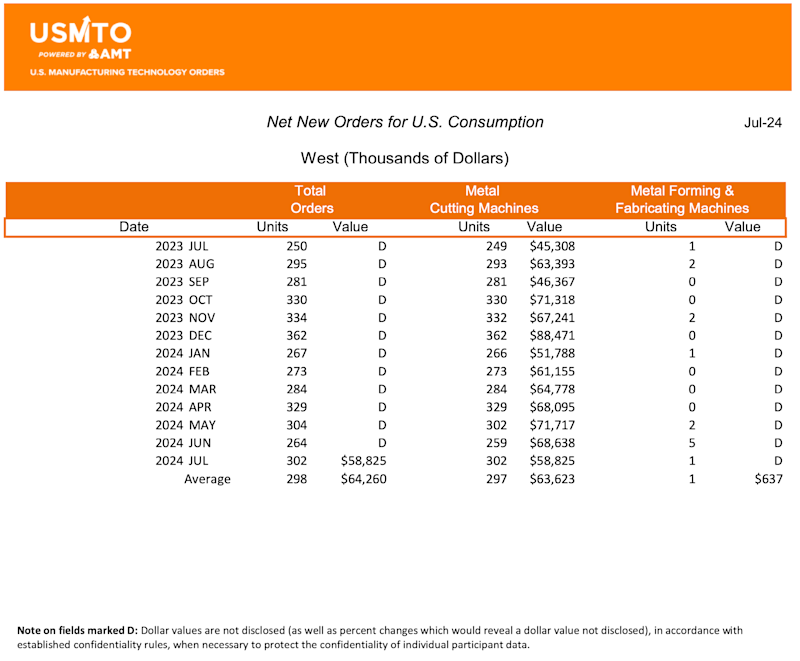

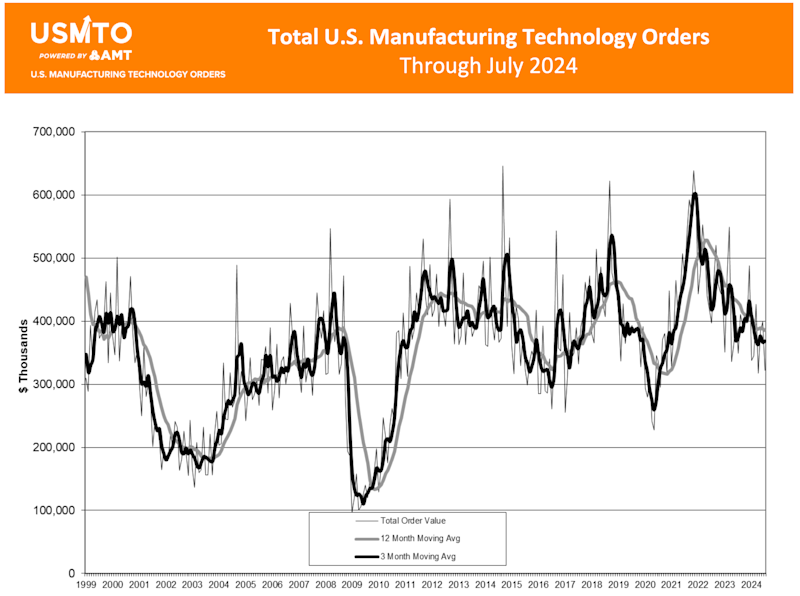

McLean, Va. (September 11, 2024) — Orders of manufacturing technology, measured by the U.S. Manufacturing ��������ֱ�� Orders (USMTO) report published by AMT – The Association For Manufacturing ��������ֱ��, totaled $321.7 million in July 2024. Orders declined 19.3% from June 2024 and declined 7.8% compared to July 2023. Year-to-date orders reached $2.53 billion, a decline of 10.5% from the first seven months of 2023.

July is typically one of the slower months of the year for manufacturing technology orders. Despite that, July 2024 is 3.8% above the pre-2020 average for the month. Cancellations were the highest since July 2023, and the ratio of cancellations to new orders remained above the historical average in all but two months of this year. Despite these mixed messages, there are signs that the industry may be at the beginning of the anticipated rebound. While the value of orders declined from June to July 2024, the number of units ordered in July 2024 increased by 1.9% over June 2024.

Contract machine shops, the largest customer of manufacturing technology, outperformed the market for the first time in several months. The value of manufacturing technology orders contracted less than 5%, while the number of units ordered increased nearly 10% from June to July. This indicates that shops are beginning to expand capacity in anticipation of their customers placing additional orders for parts.

Conversely, medical equipment manufacturers increased the value of their orders from June to July 2024 while decreasing the number of units. With a manufacturing process that requires high precision, traceability, and customization, the medical industry typically places orders for more sophisticated machinery. Some estimates predict this industry will grow by 50% between now and 2029, so this sector is poised to become a reliable customer of manufacturing technology.

Orders from manufacturers of electrical generation and distribution equipment were flat from June to July 2024. However, because July was a down month, they comprised a larger share of the total orders. This sector has pulled back orders from their peak in early 2023 but remain on an upward trend. Increased power demand from data centers as well as a larger focus on grid modernization has made this a very important sector for manufacturing technology.

After and the weak , a rate cut at the Fed's September meeting is all but certain, according to market reactions. Assuming the Fed has managed to guide the economy to a soft landing, predicting how machine tool orders will react is difficult due to the lack of historical examples of soft landings – especially compared to the many examples of recessions. Still, with the anticipated rate cut expected to begin alleviating some concerns of households and businesses, renewed demand up and down the supply chain may be on the doorstep as manufacturers converge on

# # #

The United States Manufacturing ��������ֱ�� Orders (USMTO) Report is based on the totals of actual data reported by companies participating in the USMTO program. This report, compiled by AMT – The Association For Manufacturing ��������ֱ��, provides regional and national U.S. orders data of domestic and imported machine tools and related equipment. Analysis of manufacturing technology orders provides a reliable leading economic indicator as manufacturing industries invest in capital metalworking equipment to increase capacity and improve productivity. .

AMT – The Association For Manufacturing ��������ֱ�� represents U.S.-based providers of manufacturing technology – the advanced machinery, devices, and digital equipment that U.S. manufacturing relies on to be productive, innovative, and competitive. Located in McLean, Virginia, near the nation’s capital, AMT acts as the industry’s voice to speed the pace of innovation, increase global competitiveness, and develop manufacturing’s advanced workforce of tomorrow. With extensive expertise in industry data and intelligence, as well as a full complement of international business operations, AMT offers its members an unparalleled level of support. AMT also produces IMTS – The International Manufacturing ��������ֱ�� Show, the premier manufacturing technology event in North America. AMTonline.org.

IMTS – The International Manufacturing ��������ֱ�� Show is where the creators, builders, sellers, and drivers of manufacturing technology come to connect and be inspired. Attendees discover advanced manufacturing solutions that include innovations in CNC machining, automation, robotics, additive, software, inspection, and transformative digital technologies that drive our future forward. Powered by AMT – The Association For Manufacturing ��������ֱ��, IMTS is the largest manufacturing technology show and marketplace in the Western Hemisphere. With more than 1.2 million square feet of exhibit space, the show attracts visitors from more than 110 countries. IMTS 2022 had 86,307 registrants, featured 1,816 exhibiting companies, saw over 7,600 people attend educational events, and included a Student Summit that introduced the next generation to manufacturing. Be the change at IMTS 2024, Sept. 9-14, 2024. Inspiring the Extraordinary. .