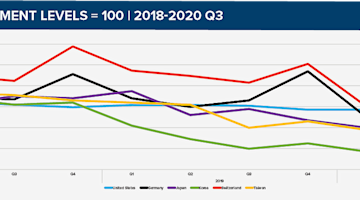

Market growth continues to pick up the pace according to both members and the posted at the beginning of August. Members shared that the rate of change has picked up but that it is still not evenly spaced across customer markets by industry.

Customers are reported to be more difficult in negotiations on terms and the need for additional information is trumping delivery. Members reported that they believe that terms and additional information have dragged out the placement of orders until late in the month. Financing has also played a role in delaying or lengthening the closing orders process. As a result, orders have tended to bunch up at the end of the month. Quotation activity is rising faster than orders are being placed, which members have said is encouraging those closing rates to improve modestly. This supports the USMTO data and our favorite pundits who have raised their forecasts.

USMTO data support members' reports that increased order activity has not developed evenly across their customer industries. Several of the key industries are lagging the general trend significantly, such as the oil and gas equipment industry. Orders from this sector have trickled upward but clearly are not supporting a sustained recovery. Mining, off-road, and construction (MOC) is experiencing a similar pattern although there is a bright spot in this sector’s story: capacity utilization has been dismal, but the MOC utilization rates have broken the 55 percent utilization rate and is climbing rapidly.

Eli Lustgarten will be expanding on the MOC forecast and its impact on capital spending at , AMT's global forecasting and marketing conference, Oct. 11-13, 2017, in Atlanta, Ga.

More than 20 other industry insiders and economic analysts will share forecasts on the automotive, aerospace, medical, and energy industries at GFMC 2017 including:

Richard Aboulafia, Teal Group

Alan Beaulieu, ITR Economics

Charles Chesbrough, C

ox Automotive Inc.

Scott Hazelton. Global Insight Inc.

Brett Smith, Conference Strategy Center on Automotive Research

To register for the conference, visit .